Sumsub, a technology company specializing in identity verification, has released a comprehensive, data-driven report highlighting global identity fraud trends and statistics.

If you are interested in current identity fraud happenings in Africa and around the world, grab a coffee and enjoy the ride.

Key findings from the report

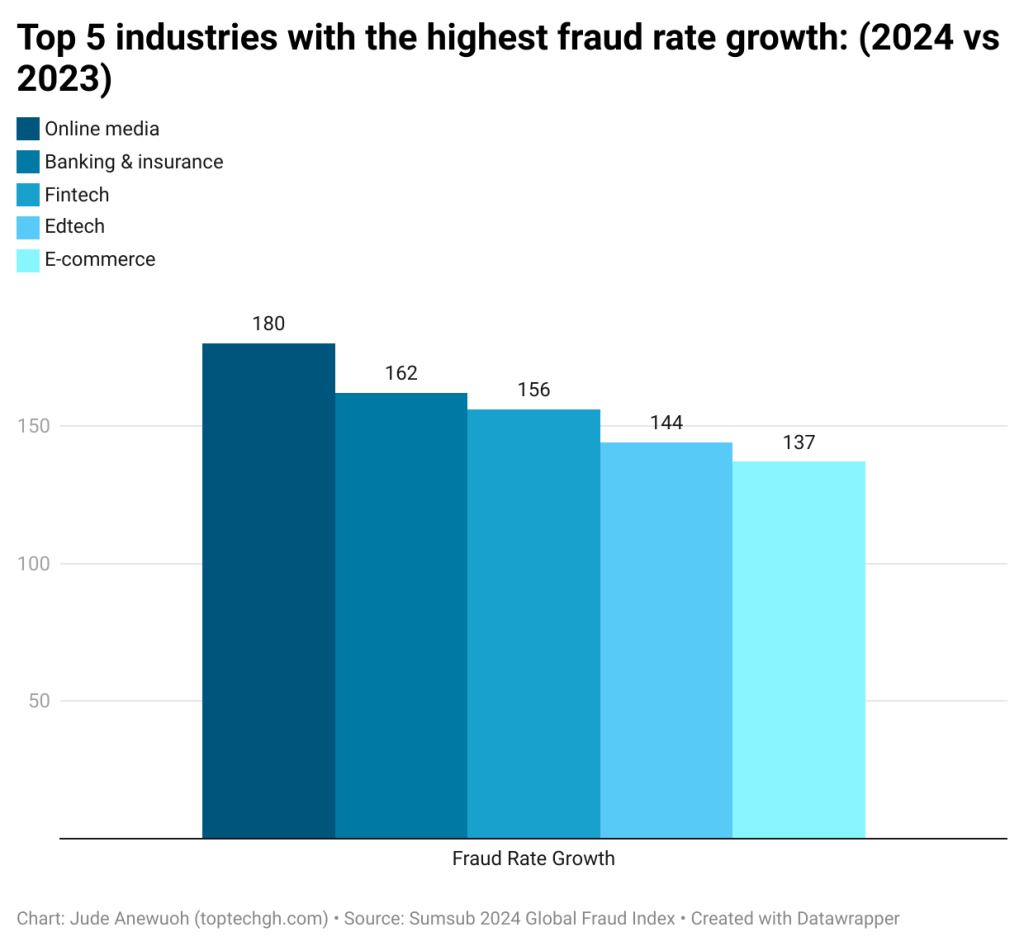

- Fraud is no longer limited to expert criminals. New technologies have made committing fraud easier,eliminating the need for specialized skills like coding or technical expertise.

- Fraudsters are increasingly relying on larger networks of people to execute their schemes, shifting from individual efforts to more organized, collaborative operations.

- Deepfakes have become the new norm. In 2024, deepfakes account for 7% of all fraud.

- On average, businesses lost approximately $300,000 per fraud event in 2024.

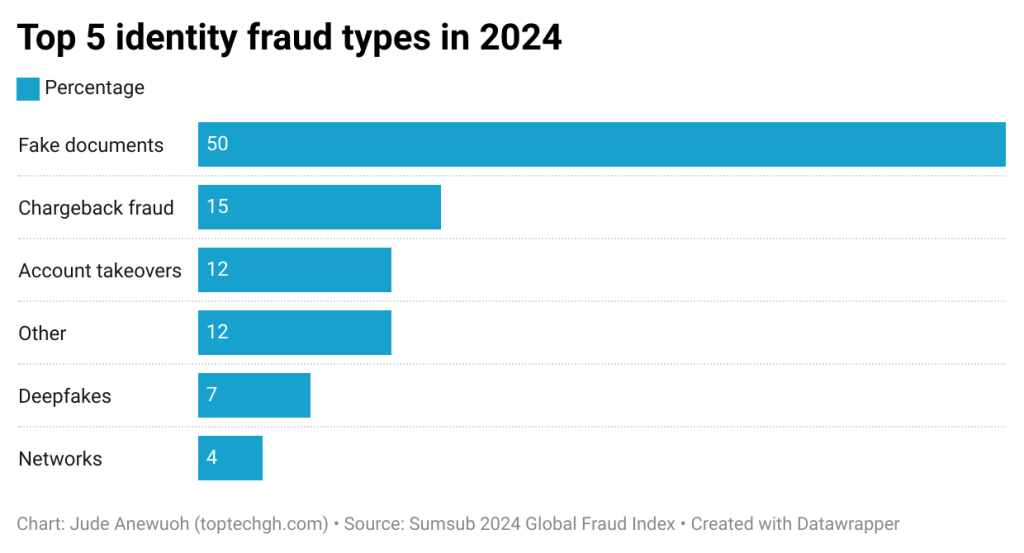

- Fake Documents: In 2024, forged or altered documents—such as fake IDs, passports, and proof of address—continue to be a leading form of identity fraud, accounting for 50% of all fraud attempts.

- Chargeback fraud: An event where a customer disputes a legitimate transaction to obtain a refund remains a persistent issue leading to 15% of all attacks. For the bigger picture, 56% of all business respondents faced chargeback fraud in 2024.

- Account takeovers: Account takeover fraud involves cybercriminals gaining unauthorized access to users’ accounts accumulated 12% of all attacks.

- Deepfakes: Data shows there has been a 4x increase in the number of deepfakes detected worldwide from 2023 to 2024, accounting for 7% of all fraud attempts.

67% of companies reported a fraud increase, with nearly half of companies (45%) and end users(44%) reporting being victims of identity fraud.

Identity Fraud Growth in Africa

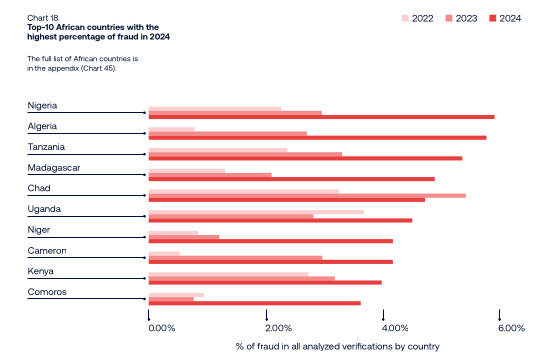

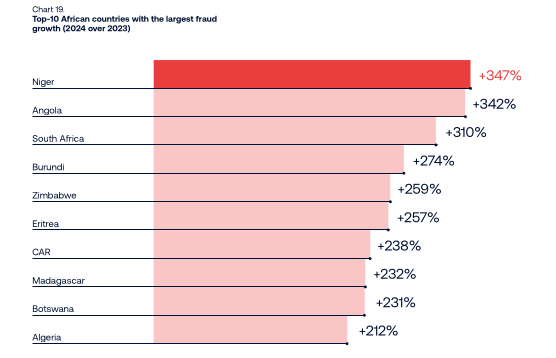

Africa’s identity fraud average growth in 2024 was estimated to be 167%. The top three countries in Africa with the highest identity fraud rates were Nigeria, Algeria, and Tanzania, unchanged from last year.

In Nigeria, the average fraud rate in 2024 reached 5.91% of all verifications, doubling from the previous year. Other countries with high fraud rates include Kenya, Uganda, Niger, and Chad.

Nigeria leads Africa with a fraud rate of 5.91%, which has doubled from last year. Algeria follows closely with a rate of 5.78%, and Tanzania recorded a rate of 5.39%.

Ghana is among the 15 countries least protected against fraud

Ghana, along with Algeria and Ethiopia, is among the 15 countries least protected against fraud globally, indicating significant gaps that need to be addressed.

Although Ghana is a tier 1 country in Africa in terms of cybersecurity, the country falls short of fraud protection just as any country sovereign in cybersecurity. No matter the policies and strategies you implement, the end user or human remains the weakest link.

According to the authority, there were 210 recorded cases of online shopping scams from January to October 2024 leading to a loss of over Ghc 410,000.

According to the Bank of Ghana (BoG) 2023 fraud report, fraud cases increased from 15,164 in 2022 to 15,865 in 2023, resulting in a total loss of approximately Gh¢88 million in 2023 as compared to GH¢82 million in 2022.

To combat cybercrime, including fraud incidents, the country is prepared to implement relevant policies and strategies to address both existing and emerging threats, as part of the strategic objectives outlined in the national cybersecurity policy.

Source: Sumsub Identity Fraud Report 2024